Strategy: To use disciplined, model-based decisions for allocating portfolios' assets between stock ETFs and bond ETFs.

Tactic:

Use a combination of fundamental and technical analysis to outperform a Benchmark Portfolio that is unmanaged with a static 60% allocation in stocks and 40% allocation in bonds.

Tactic:

Adjust portfolio asset allocations as they are moved off of baseline-neutral due to performance differences between stocks and bonds.

Tactic:

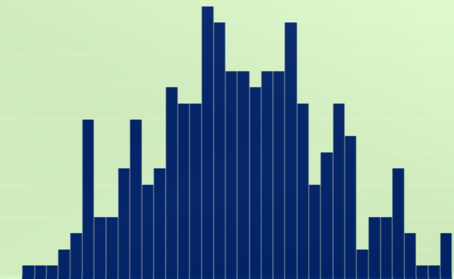

Pro-actively adjust portfolio asset allocations away from baseline-neutral contingent upon an analysis of the S&P 500 INDEX relative to the Model-Based Trend Value of the S&P 500 INDEX.

Ready to Explore New Possibilities?

There is no guarantee that this investment strategy will generate superior performance or eliminate risk and prevent investment losses. Use of the above-listed strategy and tactics does not assure that the objective will be achieved. All equity-based investments such as stocks, mutual funds, and ETFs are subject to risk, including loss of principal. Past performance is not a guarantee of similar future results.

Call Us (610) 989-0240 | [email protected]